Tillman Stock and Bond Hotline

Sample Hotlines:

May 30, 2013

September 22, 2011

We have been publishing this Hotline for more than 20 years. During that time, we have often stayed ahead of the trends. Why have we outperformed so many of our peers since the early 1990s? We do not get caught up in the swampland of minor events and political rhetoric. Instead, we are focused on the BIG PICTURE. What really drives the stock market? There are many factors, but when you boil it down to the core truth — it is the economy. The relative health or weakness of the economic landscape impacts many other things. Is there enough available credit for businesses to innovate and grow? Are revenues strong enough to entice companies to plan for such growth and other changes?

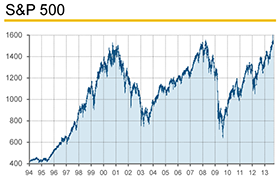

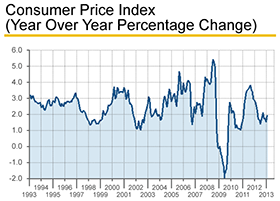

Inflation is a big part of the economy’s story. Too much inflation in a short period of time can eat away at corporate profits. The recent restrained wage growth in America has helped to bolster corporate bottom lines. That is one of the reasons that so many S&P 500 firms have been experiencing sky-high profit margins in recent years. The combination of revenue growth (driven by both domestic and overseas demand) and high profit margins has helped to drive the bull market. Most of the major stock indices hit new all-time highs during the spring of 2013 — topping the October 2007 peaks. One of the intriguing things about the recent run to new highs is the fact that so many investors refused to participate in the rally. A lot of money went running for the sidelines during the crash of 2008 and 2009. Investor confidence took a body blow and many people swore off stocks — calling them too much of a risk. In the end though, the fundamentals for the stock market have been just too bullish for the global investment community to ignore. Despite the many claims about how the U.S. economy never really emerged from the last recession, conditions have stabilized and improved in a number of industries and sectors. With market interest rates still relatively low, individual and institutional investors have been left with few alternatives if they want to tap into the economic recovery. We are glad to say that our subscribers have been onboard for nearly the entire bull market.

Not surprisingly, the people that have missed out on most or all of the post March 2009 rally often blame the entire thing on the Federal Reserve’s quantitative easing. There is no denying that every Fed announcement about a “QE” has brought a surge in the demand for equities. However, the bears have come to rely on this storyline as something more than a crutch. It has become the basis for nearly all of their analysis concerning the stock market, bonds and the economy. That focus has blinded many investors and analysts to what should have been obvious. The stock market has been benefitting from a recovery in the economy that has taken U.S. real GDP (adjusted for inflation) to new all-time highs. Corporate profits have also soared. If those two factors were not in play during the past four years, the stock market would not have gained 146% between March 2009 and May 2013! To ignore those stories is akin to trying to communicate without using verbs. You can get some of your point across but a lot of important information is lost in the process. There has been plenty of speculation regarding the Fed’s plans for the direct purchases of Treasuries and mortgage-backed securities. We are watching the situation closely. As the Fed backs away from such monetary easing, it is going to lead to a case of indigestion in the U.S. stock market. Just as has been the case for more than two full decades, we will be here to look ahead and guide subscribers when the time comes.

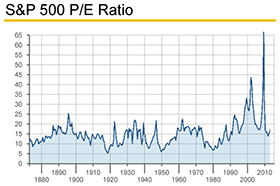

We changed our near-term investment stance toward the stock market during early 2013. The many years that we have been in this business have taught us that a buy and hold philosophy can lead to headaches. The fact that the stock market is barely higher today than it was back in early 2000 certainly shows that investors can be well served to make changes in their equity holdings based on changes in broad economic and financial trends. Back in late 1999, we turned bearish on the stock market. Our sell warning was focused on the technology sector. The market was in the midst of the biggest bubble in generations and the buying spree went on for another four months. We took some heat for sticking with our bearish stance during the final part of that bubble. The Nasdaq Composite fell by 60 percent during the year following the March 2000 peak. During the weeks after the September 11, 2001 terrorist attacks, the Nasdaq was sitting more than 70 percent below its all-time high. We reacted to the post-9/11 selloff in the stock market by turning bullish. We have shifted from bullish to bearish (and back again) on a number of occasions since then and there are more changes ahead.

This hotline is designed to take the broad economic advice found in the Money and Economy Hotline and put it to work regarding both the stock and bond markets. No one gets the market right 100% of the time. Time and again though, we have found that when our expectations for the economy are met, we are on the right side of the bullish and bearish trends in the market. There are sure to be a lot of changes regarding both stocks and bonds during the years ahead. We are looking forward to the challenge of not only helping subscribers to grow their wealth but to protect that wealth as well.