Van Eck Precious Metals and Oil Hotline

Sample Hotlines:

June 26, 2013

September 3, 2011

All the gold in the world today was created in a super nova explosion of a star billions of years ago. Gold is rare. Gold is precious. Gold is durable and has many uses — including jewelry, industrial and investment. We believe gold has a place in the modern world and it deserves your attention. The gold market is the classic canary in the coal mine. It can tell you a lot about what is happening with global financial politics. However, such lessons are often hidden and only experienced sector players can decipher the clues and turn them into real world analysis and predictions.

We have been following gold for decades. In fact, the Precious Metals and Oil Hotline just entered its third decade of weekly publication. During that time, we have seen it all. Gold has been volatile in recent years — trading between $1,185 and $1,920 an ounce. The media tends to treat gold as “just another commodity.” It is much more than that! Gold is also a currency. In fact, it is the oldest currency that is still in wide use today.

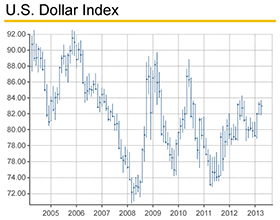

Gold is priced in U.S. dollars around the world. When the dollar weakens, it makes the metal cheaper to foreign consumers and investors. The central banks of America, Japan and Europe are in a race to pump up their respective economies with money. When compared to the price of gold, most currencies have been debased during the past decade. There is no sign that the banks will stop the flow of excess liquidity any time soon. That holds bullish implications for the price of gold!

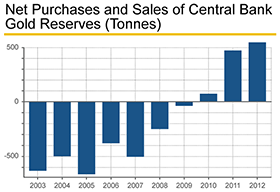

Back in the mid 1990s, we believed that something big was brewing in the gold market. For a while, the gold price was held in check by some macro headwinds. The central banks made the mistake of dumping hundreds of tonnes of their gold reserves every year. They listened to all of the Wall Street experts that said gold was dead. J.P. Morgan and other banks declared gold to be a leftover from a bygone era. Jim Cramer on CNBC enthusiastically predicted that the price was headed below $200 an ounce (1997). The short sellers kept the pressure on the metal and for a while it looked like gold would not trade above $425 an ounce again for years, decades or perhaps forever. We bided our time, looking for opportunities on the buy side. On a number of occasions during the 1990s, gold made a run above the $400 level. Each time though, the institutions and central banks came in and crushed the rally with excess supply.

With central banks (especially in Europe) selling off their gold reserves on a regular basis during the 1990s, the sector bears found it easy to whip up the level of fear in the financial community. The central banks routinely sold a net 500 tonnes or more of gold every year during that period. The UK — following Gordon Brown’s financial leadership — methodically sold its gold at regular auctions. Those auctions forced the negative news about official gold reserve sales into the headlines on a regular basis. The short sellers threw every rumor they could think of at the global gold market. For a while, the financial media dutifully reported that central bank gold sales were about to explode — perhaps reaching thousands of tonnes per year. Those were the dark days for gold sector bulls. We still have plenty of the same subscribers — 15 to 20 years later. The $250 mark proved to be the firebreak in the gold market. A combination of mining costs and price-driven physical demand around the world finally put an end to the stranglehold of the big banks and their many short seller accomplices.

The mining companies listened to the all of the dire predictions during the late 1980s and the 1990s and it scared them into hedging their future production. That activity (forward selling) is basically the same as shorting gold. Many producers went far beyond near-term production. They sold years of future mining production forward. The short sellers, central banks and producers created a perfect storm for the bears. By the time gold bottomed out near $250 an ounce (1999 to 2001), the Financial Establishment had stopped paying attention to gold. It was regarded with contempt. Well, gold was not dead… it was just resting! We took advantage of the low prices in the sector and recommended a number of mining stocks. Some of the smaller mining names would go on to post gains of more than 1,000 percent.

The U.S. government locked the price of gold at $35.00 an ounce — beginning in 1934. The U.S. dollar was then officially pegged at $35.00 as part of the 1944 Bretton Woods Agreement and that would not officially come to an end until President Nixon closed the gold window in August 1971. The decade that followed saw some of the most destructive financial events of recent history. With gold left to find its own value in the global marketplace, the price broke above the $35.00 mark in London trading (after the London Gold Pool closed in 1968). It reached about $200 an ounce by 1974 and briefly touched $850 during January 1980. The late 1979 to early 1980 spike in gold tends to get a lot of press. As far as we are concerned, it has carried far too much weight in the expectations of both the bulls and the bears during the past three decades.

After a while, recollections of historical events tend to get a little fuzzy. People like to boil a topic down to a core theme and many of the finer details get lost in the shuffle. When it comes to the $850 peak in the gold price during early 1980, the rally was very much driven by the Soviet invasion of Afghanistan. The fear at the time was that the forces of the USSR would push right through Afghanistan and move into the rich oil fields in Iran. The price of oil spiked and gold went along for the ride. The $850 an ounce price that has been mentioned so many times in sector commentaries was brief in the extreme. The price of gold spent only a handful of hours above $800. Gold was trading near $475 just a month before the early 1980 top. A week after its January 21, 1980 peak, spot gold was back down at $624.00 an ounce — a decline of 27 percent!

If the Soviets had not stumbled into their many troubles in Afghanistan, gold likely would have remained below $700 for months or even years to come. Instead though, the USSR swooped into the nation just after Christmas 1979. By the time the gold market got back up and running after the holidays, the price had jumped by nearly $100 an ounce. A truly fair peak price for that time period was more like $600 to $700 an ounce. Adjusted for inflation, such peaks today translate out to $1,925 and $2,250. Gold hit an all-time high of $1,920 in September 2011 — in the aftermath of the Standard & Poor’s downgrade of America’s debt rating. We thought gold was overextended at that time. Since then, the price has come under pressure. The old enemies of gold have come out of the woodwork of late. The gold bull market has been declared dead and buried. Some investors have abandoned the sector. Gold ETF holdings have plummeted — revealing that institutional money has been losing faith in the metal.

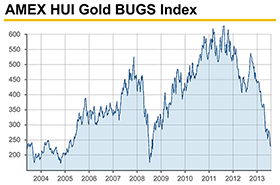

The mining stocks have been underperforming gold for quite a while now. We set up an official portfolio of gold and silver investments in November 2007. Our sector investments have gained more than 35 percent since then. During the same period of time, the HUI Gold BUGS Index (an index of largely unhedged gold and silver mining stocks) has LOST more than 50 percent of its value. The sector has seen plenty of ups and downs during the past decade. We have tried to avoid the classic mistake of loading up on new investments only after a big rally. On the other side of that equation, we always keep an open mind on the buy side during periods of weakness. Most casual investors that dabble in the precious metals sector tend to get sucked in by bullish coverage in the media only AFTER gold has run higher for weeks or months. We regard the main task of the Precious Metals and Oil Hotline to provide subscribers with a broad look at the markets. We spend a great deal of time combing through facts and figures that most analysts cannot be bothered with these days. Many commentators take a surface approach to gold. Sometimes that strategy works well for a while. In the end though, such analysis is doomed to miss major trend changes in the sector.

The media treats gold like it is 100% tied to the action in the U.S. dollar and the threat (or lack thereof) of higher inflation. Our decades of experience have taught us that gold’s story runs far deeper and the metal reacts to all sorts of forces. If you have no interest in owning mining stocks, the Hotline can still provide you with valuable insights and information regarding everything from domestic politics to the economic trends in China and Europe. Those subjects are viewed by many as being too mundane to help set the long-term trend in the precious metals and the mining stocks. We do not believe that the bull market in gold has been broken. The short sellers have lined up against gold during 2013. They are counting on a crash in gold below $1,000 — probably even back below $850 an ounce. If we see the fundamentals and technicals moving in that direction, we will act accordingly. Until gold’s bull trend is broken though, the lower prices in 2013 carry the potential for wealth building gains down the road.

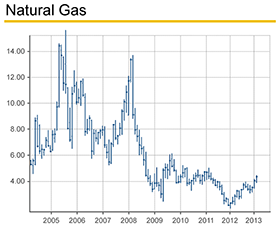

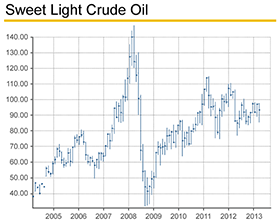

The energy sector has long been tied to the gold market. Both of those sectors tend to react to some of the same forces — currencies, global economic conditions and inflation. The price of oil has traded in an extremely wide range of about $12.00 to $150 per barrel during the years that we have followed it in this Hotline. Light sweet crude oil has bounced around between $75 and $115 during the past few years. Energy traders have run into something of a rut as they search for the next big move in crude oil, natural gas and other energy products. We believe that global energy demand will increase during the years ahead — driven in part by economic growth and population growth. After decades of energy companies sitting on cash, exploration activity has been expanded. Looking out to the decades ahead, some energy service and drilling stocks are likely to outperform their broader cousins in the sector. We began a portfolio of energy sector investments some years ago. The portfolio has outperformed the average energy sector fund and private portfolio during that time. There are a number of exciting developments in the energy industry these days. America has started to make better use of its massive energy reserves. Also, alternative energy has only just begun to make its way into the marketplace. Solar, wind and other alternative energy sources will offer savvy investors some great growth and profit opportunities during the coming decade. We plan to be right here, helping people to participate in those booms.