Van Eck Hotline on Money and the Economy

Sample Hotlines:

May 6, 2013

September 2, 2011

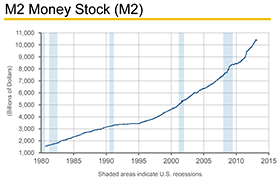

Since the 1970s, Adrian Van Eck was known as an expert on the Federal Reserve and we carry on that focus to the present day. The U.S. central bank has played an important part in the economic history of the United States during the past century. The Fed’s role has broadened quite a bit of late as Chairman Ben Bernanke has tackled some unique challenges created by the recession and the financial crisis. While Bernanke has seen more than his share of critics in recent years, he has proven to be an innovative leader and helped to save America from the deflationary depression that so many people incorrectly predicted some years back. With each new stage of quantitative easing, the Fed has grown its balance sheet — buying up billions of dollars worth of U.S. Treasury debt and mortgage-backed securities. Bernanke’s efforts helped to bring stability to the economy. The financial markets have benefited as a result. While there might be some longer-term negative consequences of the Fed’s easy money policies, those risks tend to cast long shadows in most financial commentaries. We are only interested in the FACTS. Our focus is always on the horizon — searching for important changes before they fully form and begin impacting business and investment trends.

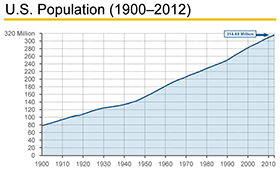

There has been a great deal of bad information offered up by all sorts of people regarding the economy during the past four years. Much of what proved to be lousy advice was tinged with politics. We understand the passion that some individuals bring to the table when it comes to politics. However, many people make the mistake of blaming everything on the president and the congress. We have long said that the economy is fueled by a combination of Money and People. Those two things also drive politics. However, the economy is steered by other, far broader forces — such as population growth, changes in technology and other innovations. The recession created a lot of pent-up demand, which is still being released into the U.S. economy. That includes demand for cars, homes and other big ticket items. American businesses are sitting on a huge pile of cash. That money is going to help shape the economy moving forward during 2013, 2014 and beyond.

That is where we come in — offering you valuable PERSPECTIVES on the past, present and future. The politicians in Washington have been running up big deficits and debt. The Federal Reserve’s low interest rate policies have helped to keep the costs of that debt down at reasonable levels. That is something that most people have missed during the recent upswing in the Federal debt. The government has financed much of the national debt at remarkably low interest rates. That has kept events from taking the scary turns that the bears have been predicting in recent years. For starters, the U.S. dollar has not collapsed and market interest rates have not exploded higher as investors lose faith in the long-term power and resiliency in the U.S. economy. A day of reckoning may arrive one day — but it is not here yet and it is almost certainly going to take more time to develop than the professional and amateur skeptics are declaring these days. We are looking to the future with hope. However, our eyes are wide open to the possible risks and we plan to guide our subscribers on paths that help to prepare them for both the best and the worst of what lies ahead.